- What is Form 10-K Filing?

- What is the Definition of the Form 10-K Filing?

- How to Find the Form 10-K Filing in SEC EDGAR?

- What is the Format of the Form 10-K Filing?

- How to Analyze the Form 10-K Filing Report?

- Form 10-K Filing â Apple (NASDAQ: AAPL) Example

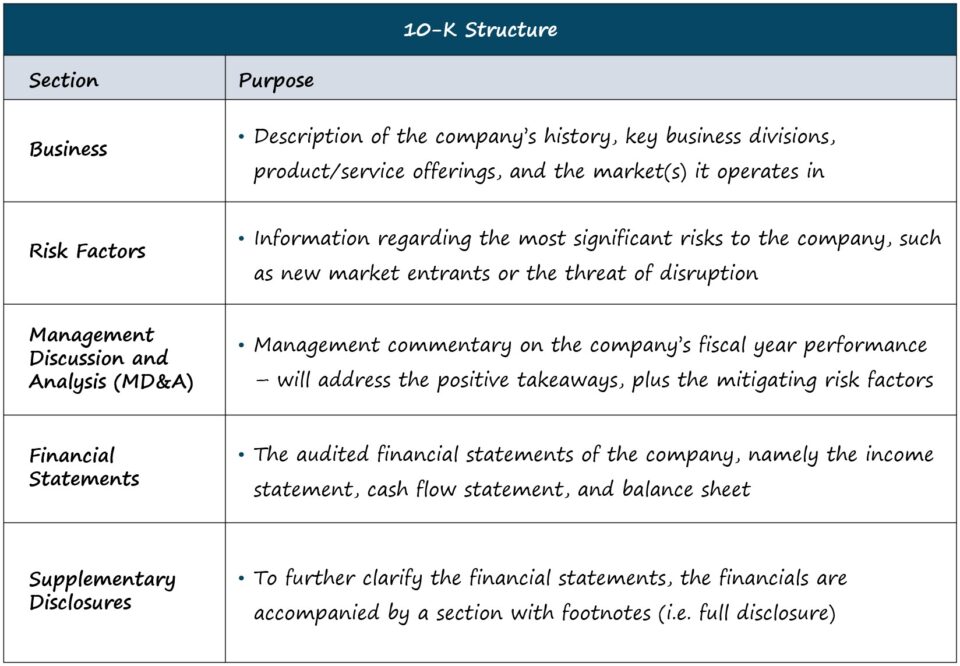

- What is the Structure of the 10-K Filing Report?

- What are the SEC Filing Deadlines for the Form 10-K Filing?

- What are the 10-K Filing Reporting Requirements?

What is Form 10-K Filing?

The Form 10-K Filing is the comprehensive, annual report required to be filed with the SEC for all publicly-traded companies based in the U.S.

What is the Definition of the Form 10-K Filing?

For public companies in the U.S., the Securities and Exchange Commission (SEC) authorizes the Financial Accounting Standards Board (FASB) to establish the reporting requirements by which all public companies must abide.

Under FASB, the financial statements of public companies must be prepared in accordance with U.S. Generally Accepted Accounting Principles (US GAAP), with the two foremost reporting being the:

- Form 10-K Filing → Required Annual Filing for the Fiscal Year (i.e. 12 Months)

- Form 10-Q Filing → Required Quarterly Filing (i.e. 3 Months)

The comprehensive 10-K aims to provide investors with all the necessary information regarding a company to make informed decisions (e.g. purchasing or selling shares).

The SEC mandates strict accounting policies to standardize financial reporting and to ensure all financials are presented fairly with sufficient transparency – in an effort to protect the interests of all stakeholders (e.g. shareholders, lenders).

Note: The form Q-4 filing filing with the SEC is the 10-K filing (i.e. year-end) for companies that follow the standard reporting dates.

How to Find the Form 10-K Filing in SEC EDGAR?

The 10-K filings of companies in the U.S. can be retrieved from the SEC EDGAR database, as shown below.

SEC EDGAR Database (Source: SEC.gov)

What is the Format of the Form 10-K Filing?

The length and complexity of each 10-K are company-specific, but the standard structure is as follows.

| Business |

|

| Risk Factors |

|

| Management Discussion and Analysis (MD&A) |

|

| Financial Statements |

|

| Supplementary Disclosures |

|

For our purposes – i.e. financial analysis and corporate valuation – the sections listed above are where most of the time is spent.

But for those looking for a more detailed explanation of all sections (e.g. corporate governance, executive compensation), the SEC provides a guide titled “How to Read a 10-K/10-Q“.

How to Analyze the Form 10-K Filing Report?

The following image is the “Table of Contents” section of the Form 10-K report filed by Facebook, Inc. (or now Meta Platforms) in 2020.

The highlighted sections are where most analysis is performed. But of course, the footnotes and non-highlighted sections of the 10-K can contain useful information on the company.

Facebook Table of Contents with Key Sections Highlighted (Source: FB 2020 10-K)

Form 10-K Filing – Apple (NASDAQ: AAPL) Example

Fill out the following form to access the 10-K filing of Apple (NASDAQ: AAPL) for fiscal year ending 2022.

What is the Structure of the 10-K Filing Report?

In the form 10-K filing, the three “core” financial statements can be found, which are the:

- Income Statement

- Cash Flow Statement

- Balance Sheet

Additionally, there are two other important filings:

- Statement of Shareholders’ Equity

- Statement of Comprehensive Income

When building financial models on companies, it’s best to get the required financial data straight from the source (i.e. EDGAR), as opposed to third-party sources that often contain mistakes — with one exception being BamSEC.

However, the financial statements alone are not enough to create a detailed financial model.

The supplementary data provided — e.g. segment level revenue breakdown, expected capital expenditures (CapEx), upcoming tailwinds/headwinds that’ll impact performance, etc. — are just as important, and should not be neglected.

What are the SEC Filing Deadlines for the Form 10-K Filing?

The specific deadline for when a 10-K report must be filed with the SEC depends on the company’s size and public float (i.e. the value of shares publicly traded in the open markets among non-insiders).Under SEC guidelines, the following rules are applied for 10-K filing deadlines:

- Large Accelerated Filer: Public Float >$700 million → 60 days post fiscal year-end

- Accelerated Filer: Public Float Between $75 million and $700 million → 75 days post fiscal year-end

- Non-Accelerated Filer: Public Float < $75 million → 90 days post fiscal year-end

What are the 10-K Filing Reporting Requirements?

Unique to the 10-K, the financials are legally required to be audited by an independent accountant.

The 10-K is also required to contain disclosures in the footnotes section regarding any material events that can impact a company’s status as a “going concern,” as well as any changes in accounting policies — which is referred to as the full disclosure principle.

In the final section, the 10-K concludes with signed letters from the CEO and CFO certifying that all of the information in the filing is accurate to the best of their knowledge.

Considering the CEO/CFO letters are signed under oath, allegations of fraud can be litigated with significant consequences if a breach of fiduciary duty is found.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

Enroll Today

Learn the layout and composition of the most commonly used financial reports.