- What are the Features of a Project Finance Model?

- Project Finance Model: Common Features

- Scrutiny on construction, modeled monthly

- Focus on Optimizing Debt

- Long term operations, modeled quarterly or semi-annually

- Not a going concern, therefore cash focused

- Hierarchy - the Cash Flow Statement becomes the Cash Flow Waterfall

- Reserve accounts

- How does all that shape a project finance model?

What are the Features of a Project Finance Model?

A Project Finance Model is a specialized financial model with distinct features, including long-term projections (often 20–30 years), detailed cash flow analysis, and comprehensive risk assessment through sensitivity analyses and scenario modeling.

The models used in project finance incorporate project-specific variables such as technical assumptions and market forecasts, alongside key financial metrics like IRR, NPV, and various coverage ratios to evaluate the project’s viability and structure its financing.

Furthermore, the more advanced features include capital structure details, contractual elements, funding schedules, and financial statements, all tailored to the unique characteristics of large-scale project financing.

Project Finance Model: Common Features

Project finance models generally share the following features:

- Scrutiny on construction, modeled monthly

- A focus on optimizing debt

- Long term operations, modeled quarterly or semi-annually

- Not a going concern, therefore cash focused

- Hierarchy — the Cashflow Statement becomes the Cashflow Waterfall

- Reserve accounts

Scrutiny on construction, modeled monthly

A solar farm might be constructed in 6 months, but a hydro dam might take 5 years (the Three Gorges project in China took 13 years). Because project finance loans have a single purpose – to finance the construction & operation of the project, debt drawdown occur in lock-step with construction of the project.Outflows of cash are large during this period to purchase components and construct the asset. Thus the construction period is and entire phase in the model, generally modeled monthly (changing to quarterly or semi-annually during operations).

Focus on Optimizing Debt

With ring-fenced cash-flows and risks heavily mitigated by contracts, project finance allows a high amount of debt, transforming a modest unlevered return into an attractive return to equity. The maximum amount of project finance debt funding possible is usually limited to gearing constraints (e.g. debt is a maximum of 70% of total project costs), and limited to a proportion of cash-flow (CFADS) to ensure debt can be repaid.

As the interest amount payable on debt feeds into both calculations, circularities arise. The model structure needs to deal with this (which also necessitates the need for a debt sizing macro).

Long term operations, modeled quarterly or semi-annually

Projects can have a long life. The operational life could be 5 years (e.g. a mine) to 120 years (e.g. Swansea Bay Tidal Project), with typical lives of 25-35 years, depending on asset class. These are not “model out 5 years and then whack a terminal value on the end” type models. The full life of the project needs to be modeled because there are differences in the cash profile at each point.

- Has the project repaid debt? If so, more cash to equity holders for the duration of the project

- Does the project need a reserve for decommissioning? If so, it may need to start building up the cash years ahead of project end.

Cashflows from the project are based around payments to stakeholders. And equity holders distribution periods are guided by debt distributions. Thus modelers typically choose to match the model periodicity to that of the debt repayment, whether it is quarterly, or semi-annually.

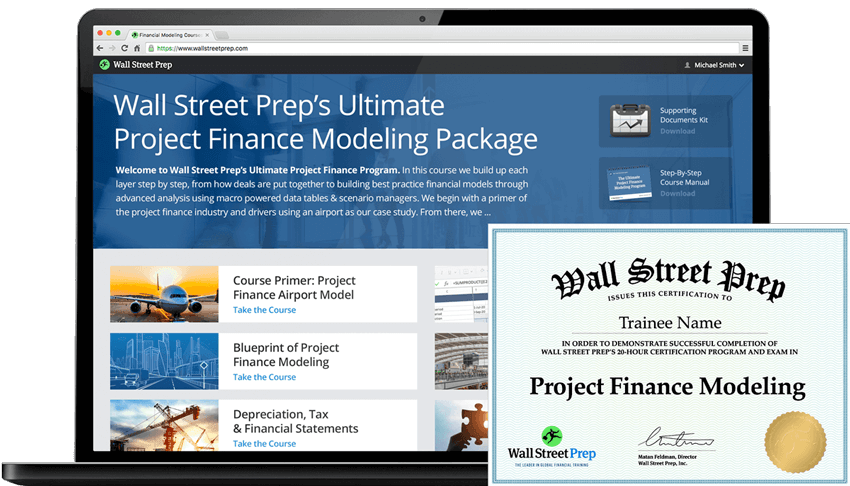

The Ultimate Project Finance Modeling Package

Everything you need to build and interpret project finance models for a transaction. Learn project finance modeling, debt sizing mechanics, running upside/downside cases and more.

Enroll TodayNot a going concern, therefore cash focused

Corporate entities are a “going concern.”

Long term debt is rolling, sitting on the balance sheet, attracting interest. The mindset is “as long as the corporate is strong and profitable, we’re going to be able to get back our principal.”

Thus, lenders scrutinize ratios like the Interest Coverage Ratio (EBIT/Interest Expense) to ensure that the company can repay its interest.

First, notice how EBIT is an accrual metric – it isn’t cash. EBIT smoothes out period-by-period cash variability – this is fine by lenders when lending to going concerns but not for projects with a clear beginning and end.

Second, notice how principal payments are missing from the coverage formula – only interest is considered. Again, this is fine by lenders when lending to going concerns who can just keep refinancing at the end of the loan’s term but not when there’s a discrete end date.

As a result, you’ll rarely see these ratios in a project finance model. Instead, you’ll see the ratio that considers both interest and principal – the Debt Service Coverage Ratio (DSCR).

The DSCR helps lenders to assess the cash coverage period by period. If lenders want to have a look overall, they can quantify the cash-flows over the length of the loan, discount them to one common point, and see how many times that nominal cash pile covers the loan balance. That is called the Loan Life Coverage Ratio (LLCR).

Hierarchy – the Cash Flow Statement becomes the Cash Flow Waterfall

The Cash Flow Waterfall has the same line items as a Cash Flow Statement, but rearranges the items according to hierarchy of cash payments.

Of course, debt has priority over equity in getting paid back, so this is reflected in numerous ways, the most obvious being that they are higher in the hierarchy for cash flows – i.e. Principal & Interest payments are senior to distributions – which ensures debt gets paid back for that specific period.

This gives rise to a Cash flow Waterfall. It has the same line items as a Cash flow Statement (well, one organized using the Direct Method rather than the Indirect Method which includes non-cash items e.g. net profit), however rearranges the items according to hierarchy of cash payments. Trade creditors get paid in preference to Tax. Then comes senior debt, the senior debts reserve accounts, in preference to subordinated debt, and finally to equity holders.

Reserve accounts

Each quarter of loan repayment is paid from that quarters cash flow. This puts individual loan repayments at risk.

Given that financing is raised off the strength of cash flows, debt repayments are calculated based off forecast cash flows and locked in with a principal repayment schedule. If this is a 15 year loan for example, this means that principal repayments that are due in 15 years are determined now. And will be paid based off the cash flow payable then.

Each quarter of loan repayment is paid from that quarters cash flow. This puts individual loan repayments at risk – for example, if oil prices have a bad quarter, an oil production project with pricing risk may not be able to cover its debt service in that quarter, which would place the project in default.

Therefore, in order to give the project a bit of breathing room from shocks such as this, there might be a Debt Service Reserve Account (DSRA) on the balance sheet. The DSRA will have cash sitting in it for emergency use, which can cover 6 or 9 months of debt service (by negotiation). This is typically funded at the end of construction (or less typically, built up from cashflows in the first few years of operation).

Other reserve accounts cater to the risk of disruption to the cash flow, e.g. though periods of capital expenditure on maintaining the assets (major maintenance reserve account – MMRA), or a change in law (Change In Law Reserve Account – CILRA).

These reserve accounts also take precedence over cash flows to equity, which means that the funding to these accounts is higher up in the cash flow. The presence of these reserve accounts helps to insulate the project from short term shocks.

How does all that shape a project finance model?

Covered above are some of the more distinctive attributes of a project financed asset. Next let’s look at the anatomy of a model that helps to deal with some of these features.