While banks are regulated by the countries in which they operate, the amount of capital banks must maintain are largely informed by an international set of standards, called the Basel II rules. An updated set of global rules – Basel III – is set to take effect shortly. Basel III includes far stricter capital requirements than Basel II to address capital shortfalls seen during the crisis. This is good news for financial stability because banks will have to maintain greater capital cushions to sustain unforeseen declines in asset values.

While banks are regulated by the countries in which they operate, the amount of capital banks must maintain are largely informed by an international set of standards, called the Basel II rules. An updated set of global rules – Basel III – is set to take effect shortly. Basel III includes far stricter capital requirements than Basel II to address capital shortfalls seen during the crisis. This is good news for financial stability because banks will have to maintain greater capital cushions to sustain unforeseen declines in asset values.

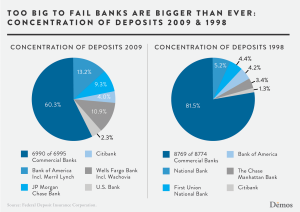

The problem, according to the IMF, is that “big banking groups with advantages of scale may be better able to absorb the costs of the regulations; as a result, they may become even more prominent in certain markets, making these markets more concentrated.” The IMF’s criticism adds to a growing number of organizations cautioning against the increasingly high level of complexity in bank regulation.

For an in depth training on how bank capital regulations affect the financial statements and valuation of financial institution, enroll in Wall Street Prep’s Bank Modeling Self Study Program.