What is the Margin Call Price?

The Margin Call Price refers to the minimum equity percentage expected to be held in a margin account before resulting in a margin call.

What is a Margin Call?

A margin call is triggered when an investor trading on margin has an account value below the minimum requirement.

A margin account is a method for investors to purchase securities on margin, i.e. investors can borrow funds from a brokerage to make investments instead of using their money.

For instance, if an investor has contributed $10,000 of their own capital to the account, which has a margin of 50% — the investor can purchase up to $20,000 worth of securities because the remaining $10,000 is borrowed from the broker.

However, the optionality to utilize borrowed capital (i.e. leverage) to make investments comes with certain requirements, namely the initial and maintenance margin.

- Initial Margin: The minimum percentage that investors must contribute before purchasing an asset using the margin loan.

- Maintenance Margin: The minimum percentage that investors must maintain in their margin accounts for their positions to remain open.

With that said, a margin call implies that the securities purchased (and thus, the account value) have declined in value to where the minimum threshold is no longer met.

Certain brokers send out warnings to investors trading on margin if an account is close to no longer meeting a requirement, but margin calls specifically request the investor to either:

- Deposit More Cash Funds (or)

- Sell Portfolio Holdings

Margin Call Price Formula

The formula for calculating the price at which a margin call is expected is shown below.

The margin call price represents the price below which the margin requirements are not met, and the investor must deposit more money or sell off a certain amount of portfolio holdings to return to compliance with the requirements.

If not, the broker could liquidate the positions, and the investor could be prohibited from trading on margin for non-compliance (and for their refusal to resolve the issue within the set timeframe).

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Jun 09 - Aug 03 cohort.

Enroll TodayMargin Call Price Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

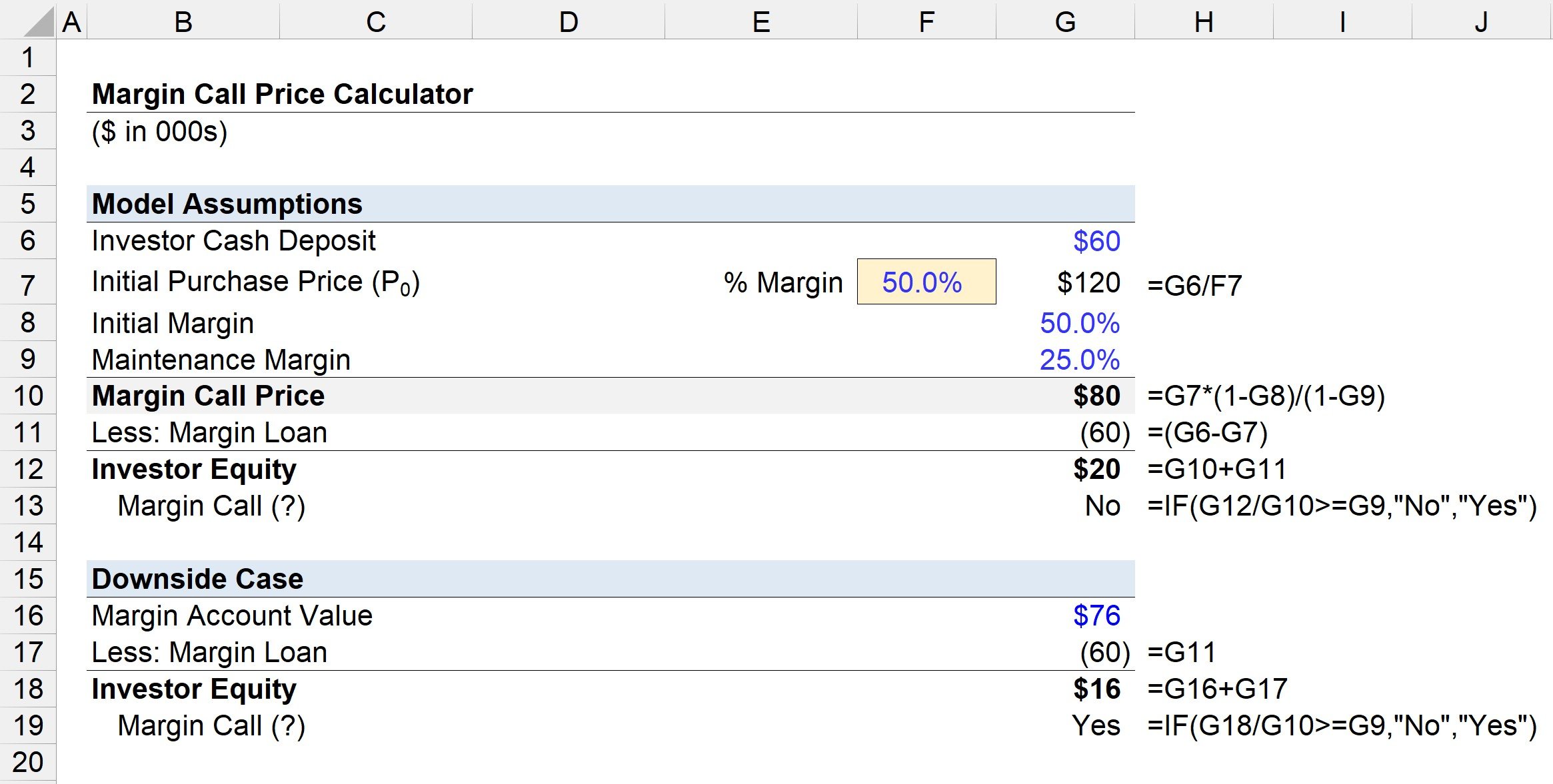

1. Margin Call Price Calculation Example

Suppose you opened up a margin account and deposited $60,000 of your own cash.

At a 50% margin, $60,000 is borrowed on margin, so the total funding available to be spent on securities is $120,000, which you decided to spend entirely on a portfolio of stocks.

- Initial Purchase Price (P₀) = $120,000

Assuming a 50% initial margin and 25% maintenance margin, we can enter our numbers into the margin call price formula.

- Margin Call Price = $120,000 × [(1 – 50%) /(1 – 25%)]

- Margin Call Price = $80,000

Therefore, your account value must remain above $80,000 at all times — otherwise, you are at risk of receiving a margin call.

The maintenance margin is calculated based on the market value of the securities held minus the margin loan, which is $60,000 in our example.

If the market value of your margin account declines to $80,000, your equity is only worth $20,000 after deducting the $60,000 margin loan.

- Investor Equity = $80,000 – $60,000

- Investor Equity = $20,000

The 25% maintenance margin is still met, so there is no margin call.

2. Margin Call Deficit Analysis Example

We’ll use the same assumptions in the next exercise as in the previous example, except for the margin account value.

After the investor placed riskier bets on options that were not unsuccessful, the account value has declined from $120,000 to $76,000.

- Margin Account Value = $76,000

If we deduct the margin loan of $60,000 from the account value, the investor equity is $16,000.

- Investor Equity = $76,000 – $60,000

- Investor Equity = $16,000

Moreover, $16,000 divided by $80,000 equals 20%, which does NOT sufficiently meet the minimum requirement of 25%.

The shortfall, i.e. the deficit that must be addressed promptly, is $4,000.

- Account Deficit = $80,000 – $76,000

- Account Deficit = $4,000

In this second case, the account value is short $4,000, as the maintenance margin is just 20% rather than the required 25% — so the broker will soon issue a formal margin call to ensure a deposit is made or securities are sold to make up the difference.

What are the Consequences of Failing to Meet a Margin Call?

Suppose your margin account value falls below the set maintenance requirement.

In that case, the broker will make a margin call requesting a cash deposit or liquidation of securities, so there is no longer a shortfall.

If unable to meet the margin call, the broker can liquidate your securities themselves at their discretion to increase the equity held in your account to meet the maintenance requirement.

If an investor cannot meet the margin, the brokerage firm has the right to close out open positions on behalf of the investor so that the account is back to meeting the minimum value, i.e. a “forced sale.”

As part of the agreement to open a margin account, the broker has the right to liquidate positions without the investor’s approval, albeit the forced sale is the last resort typically done after several unsuccessful attempts to reach the investor.

The fees associated with the transactions are billed to the investor, along with interest on the loan — or in some cases, there are fines charged to the investor for the inconvenience.

If the failure to respond to margin calls is a recurring occurrence, a brokerage firm could sell the investor’s entire portfolio and close the margin account.