- What is a Reverse Stock Split?

- How Does a Reverse Stock Split Work?

- How Do Reverse Stock Splits Impact Share Price?

- Reverse Split Rationale: NYSE Market Exchange Delisting

- Reverse Stock Split Formula Chart

- Reverse Stock Split Calculator

- Step 1. Reverse Stock Split Ratio Scenario Assumptions (1-for-10)

- Step 2. Calculate Number of Post-Reverse Shares Owned

- Step 3. Post-Reverse Split Share Price Impact Analysis

- General Electric (GE) Reverse Stock Split Example in 2021

What is a Reverse Stock Split?

A Reverse Stock Split is performed by companies attempting to increase their share price by reducing the number of shares in circulation.

How Does a Reverse Stock Split Work?

In a reverse stock split, a company exchanges a set number of shares it previously issued for a fewer number of shares, but the value attributable to each investor’s overall holdings is kept the same.

After the reverse stock split, the share price rises from the reduction in share count – yet the market value of equity and ownership value should remain the same.

The reverse split essentially converts each existing share into a fractional ownership of a share, i.e. the opposite of a stock split, which occurs when a company divides each of its shares into more pieces.

Upon conducting the split, the price of the post-split adjusted shares should rise since the number of shares declines.

- Stock Split → More Shares Outstanding and Lower Share Price

- Reverse Stock Split → Fewer Shares Outstanding and Greater Share Price

How Do Reverse Stock Splits Impact Share Price?

The concern with reverse stock splits, however, is that they tend to be perceived negatively by the market.

The announcement of a reverse stock split often sends out a negative signal to the market, so companies are typically hesitant to perform reverse stock splits unless necessary.

In theory, the impact of reverse splits on a company’s valuation should be neutral, as the total equity value and relative ownership remain fixed despite the change in share price.

But in reality, investors can view reverse splits as a “sell” signal, causing the share price to decline even further.

Since management is aware of the negative consequences of a reverse split, the market is even more likely to interpret such actions as an admission that the company’s outlook appears grim.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Jun 09 - Aug 03 cohort.

Enroll TodayReverse Split Rationale: NYSE Market Exchange Delisting

The reason for engaging in a reverse split is normally related to the share price being too low.

Public companies listed on the New York Stock Exchange (NYSE) run the risk of being delisted if their share price declines below $1.00 for more than 30 straight days.

In an effort to avoid delisting (and the embarrassment of such an occurrence), management can propose a formal request to the board of directors to declare the reverse split to emerge above the $1.00 threshold.

Reverse Stock Split Formula Chart

The following chart outlines the most common reverse split ratios, along with the formulas to compute the post-split shares owned by the investor and the split-adjusted share price.

| Reverse Stock Split Ratio | Post-Split Shares Owned | Reverse Split Adjusted Share Price |

|---|---|---|

| 1-for-2 |

|

|

| 1-for-3 |

|

|

| 1-for-4 |

|

|

| 1-for-5 |

|

|

| 1-for-6 |

|

|

| 1-for-7 |

|

|

| 1-for-8 |

|

|

| 1-for-9 |

|

|

| 1-for-10 |

|

|

Reverse Stock Split Calculator

We’ll now move to a modeling exercise, which you can access by filling out the form below.

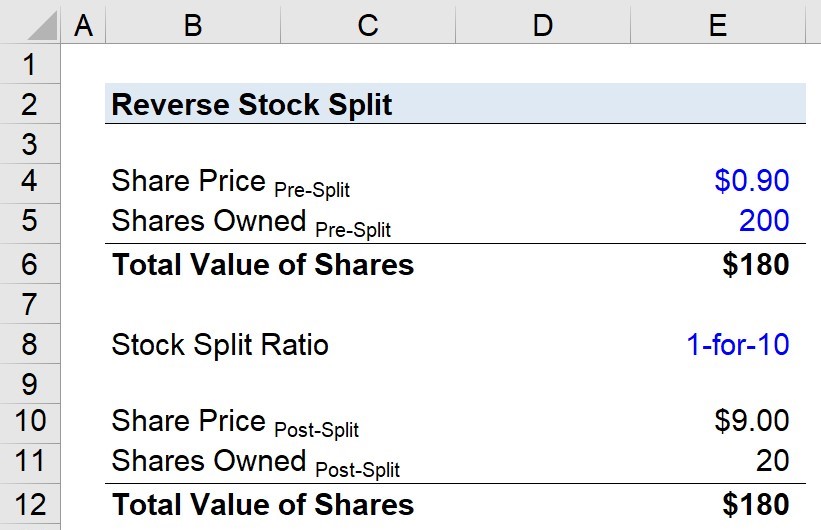

Step 1. Reverse Stock Split Ratio Scenario Assumptions (1-for-10)

The number of shares owned after the reverse split can be calculated by the stated ratio of the stock split multiplied by the number of existing shares owned.

For instance, a 1-for-10 reverse split ratio equals 10%, which can be thought of as exchanging ten $1.00 bills for a single $10.00 bill.

- 1 ÷ 10 = 0.10 (or 10%)

Step 2. Calculate Number of Post-Reverse Shares Owned

Suppose that you are a shareholder with 200 shares before the reverse split – under a 1-for-10 reverse split, you would own 20 shares afterward.

- Shares Owned Post-Reverse Split = 10% × 200 = 20

Step 3. Post-Reverse Split Share Price Impact Analysis

Next, let’s assume that the company’s pre-split share price was $0.90.

The post-reverse split share price is calculated by multiplying by the number of shares consolidated into one share, which is ten in our illustrative scenario.

- Share Price Post-Reverse Split = $0.90 × 10 = $9.00

Initially, the market value of your equity is worth $180.00 (200 Shares × $0.90), and after the reverse split, they are still worth $180.00 (20 Shares × $9.00).

But to reiterate from earlier, the market reaction to the split determines whether there truly is no value lost over the long run.

General Electric (GE) Reverse Stock Split Example in 2021

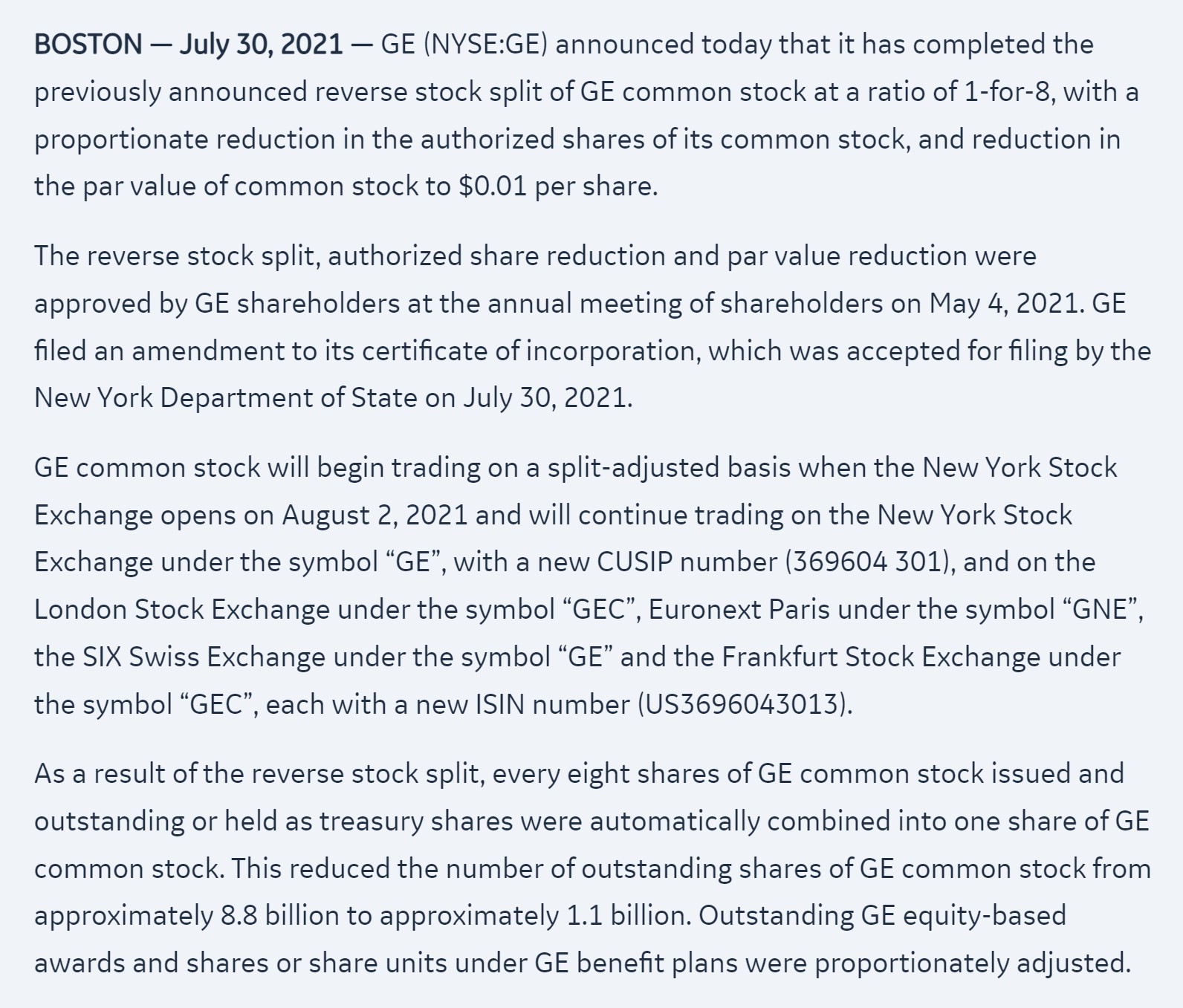

In actuality, reverse splits are quite uncommon, especially by blue-chip companies, but one recent exception is General Electric (GE).

General Electric, the one-time leading industrial conglomerate, declared a 1-for-8 reverse stock split back in July 2021.

General Electric 1-for-8 Reverse Split (Source: GE Press Release)

The decision came after GE’s market capitalization reached around $600 billion in 2000, making it one of the most valuable publicly traded companies in the U.S.

But after the 2008 financial crisis, GE Capital took significant losses and encountered a series of failed acquisitions around non-renewable energy (e.g. Alstom).

GE’s poor acquisition strategy garnered a reputation for “buying high and selling low,” as well as often doubling down on unproductive strategies.

Since then, GE’s market cap has declined more than 80% after a decade comprised of operational restructuring (e.g. cost-cutting, lay-offs), divestitures to meet debt obligations, asset write-downs, legal settlements with the SEC, and the removal from the Dow Jones Industrial Average.

GE Market Capitalization from 2000 to 2021 (Source: Refinitiv)

General Electric (GE) proposed an 8-for-1 reverse stock split to raise its share price which was barely staying above double digits so that its share price would be more in line with comparable peers such as Honeywell, which was trading above $200 per share.

The board approved the corporate decision of directors, and GE’s share price post-split increased 8x while the number of shares outstanding was reduced by 8.

GE’s reverse split-adjusted share price traded at approximately $104 with optimism surrounding CEO Larry Culp’s initiatives to turn around GE back by selling off non-core assets and streamlining operations.

- Number of Shares Outstanding: ~ 8.8 billion → 1.1 billion

- Share Price: ~ $14 → $112

However, GE’s turnaround encountered numerous obstacles, and currently, its shares trade at a sub-$90 per share.

GE eventually announced in late 2021 that it plans to split up into three separate publicly traded companies.

The reverse stock split of GE, which many consider a failure, fell short in addressing the actual underlying issues within the company that caused its downfall – i.e. the outcome of the reverse split is contingent on the management team implementing operating initiatives for real long-term value creation.