- What are Variable Costs?

- How to Calculate Variable Costs

- Variable Cost vs. Fixed Cost: What is the Difference?

- Variable Cost Formula

- Variable Cost Per Unit Formula

- Variable Cost Calculation Example

- What are Examples of Variable Costs?

- How Do Variable Costs Affect Operating Leverage?

- How Do Variable Costs Impact Break Even Point?

What are Variable Costs?

Variable Costs are output-dependent and subject to fluctuations based on the production output, so there is a direct linkage between variable costs and production volume.

How to Calculate Variable Costs

Variable costs, or “variable expenses”, are connected to a company’s production volume, i.e. the relationship between these costs and production output is directly linked.

Unlike fixed costs, these types of costs fluctuate depending on the production output (i.e. the volume) in a given period. Since costs of variable nature are output-dependent, the costs incurred increase (or decrease) given varying production volumes.

Variable costs are directly tied to a company’s production output, so the costs incurred fluctuate based on sales performance (and volume).

If product demand (and the coinciding production volume) exceed expectations — in response, the company’s variable costs would adjust in tandem.

- Increased Production Output → Greater Variable Costs

- Decreased Production Output → Reduced Variable Costs

As more incremental revenue is produced, the growth in the variable expenses can offset the monetary benefits from the increase in revenue (and place downward pressure on the company’s profit margins).

Variable Cost vs. Fixed Cost: What is the Difference?

The differences between variable costs vs. fixed costs are as follows:

- Variable Costs → The costs incurred that are directly tied to production volume and fluctuates based on the output in the given period.

- Fixed Costs → The costs incurred that remain the same regardless of production volume.

From the viewpoint of management, variable expenses are easier to adjust and are more in their control, while fixed costs must be paid regardless of production volume.

Fixed costs encompass a company’s obligations irrespective of the production output (e.g. rent, insurance premium) and occur periodically based on a pre-determined schedule, and are usually easier to predict and budget for.

In contrast, costs of variable nature are generally more difficult to predict, and there is usually more variance between the forecast and actual results. The amount incurred is directly tied to sales performance and customer demand, which are variables that can be impacted by “random” factors (e.g. market trends, competitors, customer spending patterns).

For example, a company executive’s base salary would be considered a fixed cost because the dollar amount owed by the company is outlined in an employment contract signed by the relevant parties.

But the bonus portion of the executive’s compensation is “variable” since the bonus is performance-based compensation and contingent on the company reaching certain targets thresholds on performance metrics such as:

- Share Price

- Revenue

- Profit Margin (%)

Variable Cost Formula

Since a company’s total costs (TC) equals the sum of its variable (VC) and fixed costs (FC), the simplest formula for calculating a company’s variable costs is as follows.

More specifically, a company’s variable costs are equal to the total cost of materials plus the total cost of labor:

Alternatively, a company’s variable costs can also be calculated by multiplying the cost per unit by the total number of units produced.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Learn how institutional investors identify high-potential undervalued stocks. Enrollment is open for the Feb. 2026 cohort.

Enroll TodayVariable Cost Per Unit Formula

The average variable cost, or “variable cost per unit,” equals the total variable costs incurred by a company divided by the total output (i.e. the number of units produced).

Calculating the average variation can be useful when it comes to assessing how variable costs are changing (i.e. rising or declining) as the company continues to grow, and ensures there are no inefficiencies where the VCs offset the benefit of higher output.

Variable Cost Calculation Example

Suppose that a consulting company charged 1,000 hours of services to its clientele.

If the total variable expenses incurred were $100,000, the variable cost per unit is $100.00 per hour.

- Variable Cost Per Unit = $100,000 ÷ 1,000 = $100.00

If the consulting company continues to scale and the number of clients (and hours billed) increases, the variable costs also increase — which can place downward pressure on the company’s profit margins (i.e. requiring more hiring and a more complex organizational structure).

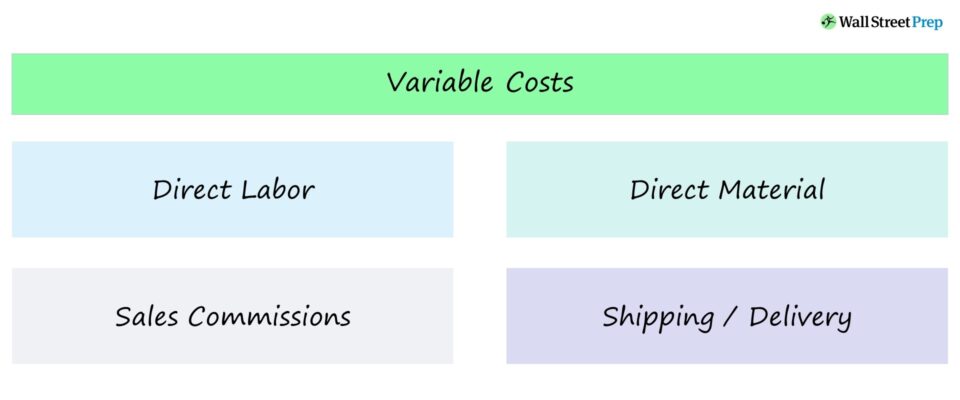

What are Examples of Variable Costs?

The following list contains common examples of variable expenses incurred by companies.

- Direct Labor

- Direct Material Cost (e.g. Raw Material)

- Sales Commissions

- Management Bonuses

- Employee Stock-Based Compensation

- Shipping Costs

For example, in the case of an e-commerce company, the delivery, and shipping fees associated with each sale would be classified as a variable expense, while utilities would be a fixed expense.

If a higher volume of products is produced, the amount of delivery and shipping fees also incurred increases (and vice versa) — but utility costs remain constant regardless.

How Do Variable Costs Affect Operating Leverage?

The concept of operating leverage is defined as the proportion of a company’s total cost structure comprised of fixed costs.

- High Operating Leverage → Higher Proportion of Fixed Costs in Cost Structure

- Low Operating Leverage → Lower Proportion of Fixed Costs in Cost Structure

If a company has low operating leverage — i.e. a higher percentage of variable costs — then each incremental dollar of revenue can potentially generate lower profits because variable costs would offset any increases in revenue.

However, the risk associated with high operating leverage is that if customer demand and sales are lackluster, then the company is restricted in terms of potential areas for cost-cutting.

In effect, a company with low operating leverage can be at an advantage during economic downturns or periods of underperformance.

Since variable costs are tied to output, lower production volume means fewer costs are incurred, which eases the cost pressure on a company — but fixed costs must still be paid regardless.

How Do Variable Costs Impact Break Even Point?

The break-even point refers to the minimum output level in order for a company’s sales to be equal to its total costs.

Suppose a company’s cost structure consists of mostly variable costs — in that case, the inflection point at which a company starts to turn a profit is lower (i.e. compared to those with higher fixed costs).

The higher the percentage of fixed costs, the higher the bar for minimum revenue before the company can meet its break-even point.

High operating leverage can benefit companies since more profits are obtained from each incremental dollar of revenue generated beyond the break-even point.

However, below the break-even point, such companies are more limited in their ability to cut costs (since fixed costs generally cannot be cut easily).